In my previous blog, I have detailed out how the common man undergoes tremendous suffering due to persistently high inflation. Now I will try to present a case on why Inflation has been relatively high in the UPA regime.

We can clearly see that Inflation has been stubbornly high in UPA regime. The inflation during the last decade has been obtained from World bank database as I did in my previous blog.

Inflation is primarily caused by two kinds of shocks, supply side shocks and demand side shocks. In simple economic terms, Price is determined by the balance between supply and demand for a product. Hence prices rise when a) Demand for a product increases (eg: Roses on Valentine's Day) or b) Supply for the product drastically reduces (eg: Food grains during a drought)

Now let us analyse, What is the primary cause for Inflation for the past 7/8 years in India. Is it due to supply side effects or demand side effects?

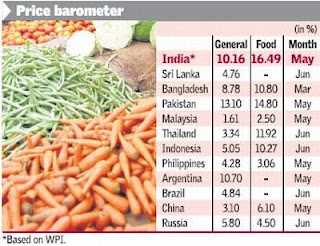

Lets look at the supply side first. If supply side was truly the cause for the prolonged period of high inflation. Then a drastic fall in production and supply of a basket of important products would have been the main cause for such an event. But was there any event in the last 7/8 years that would suggest such as shock?? No, though rising oil prices could be classified to fall in the category of a supply side shock to the Indian economy, it could at the most explain 20/30% of the rise in inflation rates. At the same time food inflation has been in double digits for most of the time period, but there are no supply side events to explain the same. Barring the drought in 2008, India has recorded bumper crops year on year. In fact food grain production has increased by annual rate of 3.8% or cumulatively by 25% in the period between 2005 and 2011. This comes as a surprise, if the food grain production has increased and that too with bumper crops, grains were stored in the open ground due to lack of storage space, why has the food inflation been stubbornly high. Clearly supply side economics cannot explain the causes for high inflation.

Hence we can clearly state that inflation has to be driven by demand side economics. But first let me explain on how macro-economic fundamentals are actually responsible for inflation. The main culprit for inflation is persistently high current account deficits run by the central government.

We can clearly see that inflation seems to be inversely correlated with current account surplus, the more the deficit in an year, higher has been inflation in that year. In the year between 2001 to 2004, central government maintained a current account surplus and the inflation in the same period was well below 5%, Compare that, to the period between 2005 to 2010, deficits have progressively increased from -1.2% in 2005 to -3.1% in 2010, inflation has correspondingly increased from 6.1% to 8.9% in 2010. Clearly there seems to be a relation between current account deficits and inflation.

Now let me explain how, current account deficit creates inflation. I will explain the concept in simpler terms without using economic jargon's and technicalities. Current account deficit is the difference between what the government spends and what it earns. A current account deficit implies that government is spending more than what it earns and a surplus means that the government spending is well within what it earns.

If the government is spending more than what it earns, how does it bridge the gap. The government like any profligate individual, borrows money to cover the gap. In case of central government, it borrows from the public through a variety of mechanisms but primarily by issuing government bonds and selling it to PSU banks and other investors. But there is also one important buyer for government bonds and that is RBI. RBI is the lender of the last resort and also regularly buys and supports government bonds. If you are wondering how RBI buys vast amounts of government bonds, well the answer is simple, it prints the money needed to buy the bond. Hence RBI finances the government by simple mechanism of printing more money. Though the actual mechanism of how government goes on about doing this is not quite simple. In fact, RBI need not print any extra money, but can achieve this by changing certain monetary policy mechanisms.

The government has utilized this extra money mainly for increasing the subsidy doled out to its electoral vote banks. Subsidy as share of total expense increased from 45% in 2004 to 60% in 2010. In naive sense, government has resorted to giving free money to people. The implication of this is very straight forward, as the money that people have increases, the demand for goods and services increases. Hence the rising dole outs increased the money supply to the common man, thus increasing the demand for all kinds of products and goods. Hence this clearly corroborates, how the present high inflation is purely demand side phenomenon driven by excessive spending by the central government.

If we need further proof for the same, foreign exchange market is clear indicator for the value of a currency. If the government increases the money supply, the value of the currency vis a vis other currency depreciates. The value of US dollar stood at INR 45 in 2004, while the value of US dollar stands at INR 52-53 today. The depreciation in the value of rupee w.r.t US dollar is a clear indicator of increased money supply.

Hence UPA government's excessive splurging in order to further it's own selfish interest of getting the "Prince" elected as PM and in pursuing pseudo socialistic policies has brazenly increased the money supply. By doling out money to garner votes, it has created a perception of creating wealth, while in reality UPA's macro-economic mismanagement has destroyed the wealth of majority of the people and only a few cronies have enriched themselves in last 8 years, all in the name of serving Aam Aadmi.